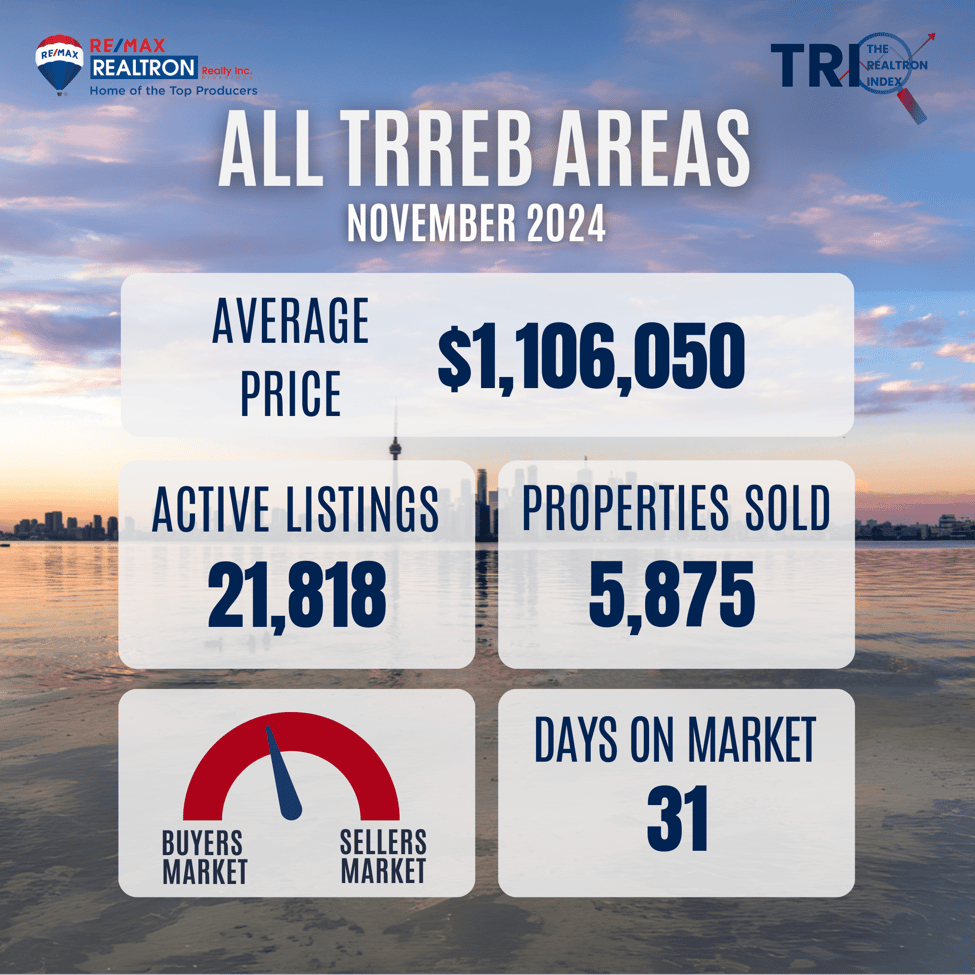

A good month of sales in November as Toronto realtors sold 5,875 homes, 40.1% more than just a year ago. Lower borrowing costs have made home ownership more affordable, and buyers are taking advantage. The inventory of homes available for sale now stands at 21,818, offering a choice of homes, something the GTA market has not often had. The average price in the GTA year to date now stands at $1,120,000, 5.9% below the record average price of 1,190,742, set in 2022. While the average price being down 5.9% seems not too bad, I believe the real number is much lower than that. The reason being that the high borrowing costs impacted the sales of luxury homes, those over $2.500,000, and fewer of those homes sold, lowering the total average sale price.

As we enter 2025, I expect to see a further lowering of interest rates, more buyers entering the market, and less choice as we progress into the spring and summer markets.

Great buying opportunities exist in the lower and high end of the real estate market. The high end, more impacted by interest fluctuations and increased land transfer taxes, and the low end, condominiums, due to an oversupply caused by the high borrowing costs of 2024.

But these factors will not last indefinitely. Housing starts in 2022-2024 were at historically low numbers, while immigration was at an all time high. As the economy continue to improve and confidence grows, we will start transitioning back to a tight market with little inventory of homes for sale resulting in bidding wars and rising prices.

The next few months represent a great opportunity to get into the market. Whether an investment property, upgrading your home or buying a condominium for your kids. Give me a call, I would love to chat, to answer all your questions and to help you achieve your goals!

All the best in the Holiday Season!

As we enter 2025, I expect to see a further lowering of interest rates, more buyers entering the market, and less choice as we progress into the spring and summer markets.

Great buying opportunities exist in the lower and high end of the real estate market. The high end, more impacted by interest fluctuations and increased land transfer taxes, and the low end, condominiums, due to an oversupply caused by the high borrowing costs of 2024.

But these factors will not last indefinitely. Housing starts in 2022-2024 were at historically low numbers, while immigration was at an all time high. As the economy continue to improve and confidence grows, we will start transitioning back to a tight market with little inventory of homes for sale resulting in bidding wars and rising prices.

The next few months represent a great opportunity to get into the market. Whether an investment property, upgrading your home or buying a condominium for your kids. Give me a call, I would love to chat, to answer all your questions and to help you achieve your goals!

All the best in the Holiday Season!